US President Joe Biden defended this Saturday the use of diplomacy as a tool to agree with other world leaders to adopt a global minimum corporate tax of at least 15% as a measure to achieve a fairer tax system and prevent companies from benefiting from compliant tax regimes.

In his official Twitter account, Biden assured that this pact “is more than a simple tax agreement”, as it is an example of how “diplomacy is reshaping the global economy and providing benefits to the population.”

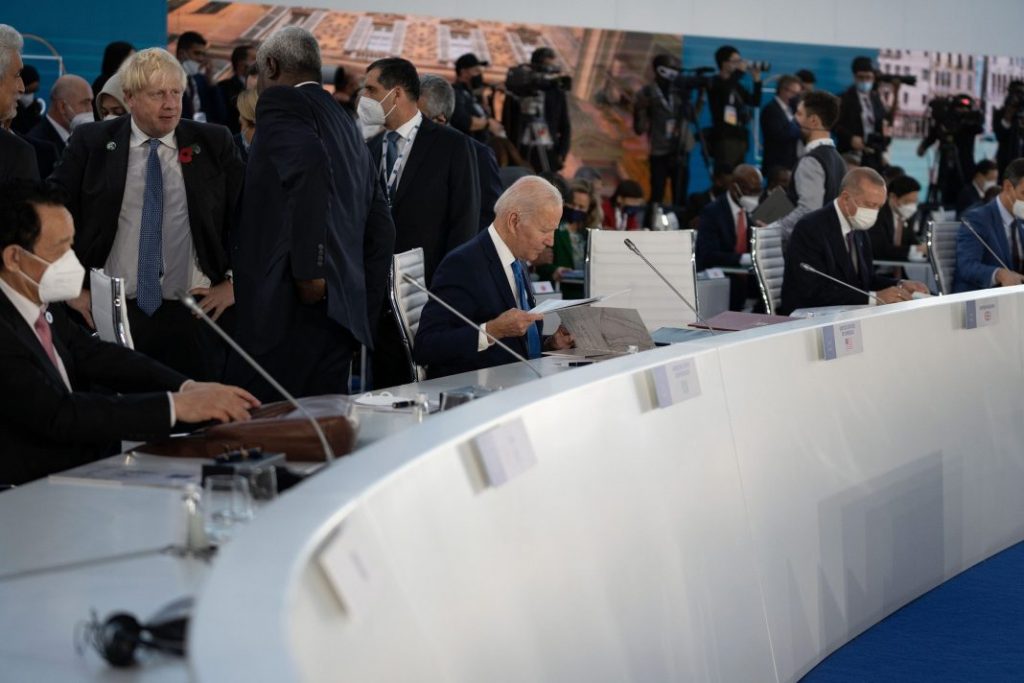

“Here at the G20, leaders representing 80% of global GDP, both allies and competitors, made clear their support for a strong global minimum tax. This is more than just a tax deal: it is diplomacy that is reshaping our economy. global and delivering benefits to our people, “said Democrat Biden after the pact was made public.

This public support for multilateralism is totally different from the position of his predecessor in office, former President Donald Trump (2017-2021), who criticized diplomacy throughout his four years in the White House.

Who also applauded the use of diplomacy to reach this agreement was Italian Prime Minister Mario Draghi, leader of this year’s G20.

“It is clear that multilateralism is the best answer to all the problems we face today. In many ways, it is the only possible answer,” Draghi said in his opening speech to the summit.

According to sources familiar with the agreement agreed this Saturday, the adoption of a global minimum tax, which will be adopted by 2030, follows the path already outlined by the Organization for Economic Cooperation and Development (OECD) of a system based on two pillars.

The first establishes that the volume of the companies’ residual profit (the one that remains after the country where the headquarters is located has kept the tax corresponding to 10% of the profitability) will be distributed between the countries where the companies operate and the second, it establishes a minimum corporate rate of 15% for companies that have a turnover of at least 750 million euros.

On October 8, the OECD reported that 136 countries and jurisdictions, which cover more than 90% of world GDP out of the 140 that participate in the negotiations, agreed that for the first pillar the figure would be 25% of that residual profit after until now it was being discussed between a range between 20 and 30%.

The summit began today with a session dedicated to the global economy and health and will conclude tomorrow with a press conference by Draghi, which will summarize the agreements reached on issues such as taxation, pandemic, economic recovery, and climate change.